Enhanced Cybersecurity, Lower Cybersecurity Premiums

As cyber insurance requirements get stricter and more comprehensive, small and medium-sized businesses need to have the right safeguards in place. This helps to lower premiums and maintain current insurance coverage.

The Challenge of Rising Cyber Insurance Premiums

In today’s digital landscape, businesses face heightened vulnerability to cyberattacks. As cybercriminals increasingly target them, cyber insurance premiums soar while coverage requirements expand. Many businesses find themselves unable to obtain coverage because they lack the necessary security protocols.

This puts many businesses at risk of losing current coverage.

Don't delay protecting your company. Contact us to learn how to keep your business protected and keep your cyber insurance premiums affordable.

Top Cyber Insurance Requirements

It’s no longer enough to keep your systems up and running; now, ensuring your business is insurable is equally vital. At Convergence we can help you address these areas to help you effectively maintain your premiums.

Cyber Awareness Training for Employees

Conducting periodic training for employees on identifying and avoiding common cyber threats can create a more security-conscious workforce and decrease the likelihood of human error leading to security breaches.

Incident Response Plan

We work with you to build a well-defined and tested incident response plan so you can show insurers that your business is prepared to handle cyber incidents promptly and efficiently, potentially reducing the financial impact of such events.

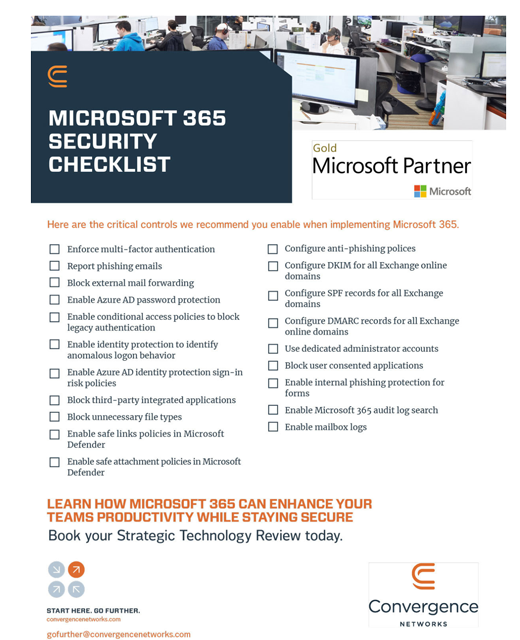

Robust Cybersecurity Measures

Implementing strong and effective cybersecurity measures, such as firewalls, encryption, multi-factor authentication, email protection, credential monitoring, and regular software updates, can demonstrate a commitment to protecting sensitive data and reduce the risk of cyber incidents.

Data Backup and Recovery

Maintaining regular data backups and having a robust disaster recovery plan can mitigate the damage caused by data breaches and ransomware attacks, which may lead to more favorable premiums.

Regular Vulnerability Scans

Conducting regular security audits by independent third parties can provide insurers with greater confidence in the business's cybersecurity practices, potentially leading to lower premiums.

Advanced Threat Hunting

Proactively searching for cyber threats in your environment.

Cyber Risk Assessments

Businesses can perform comprehensive cyber risk assessments to identify vulnerabilities and address potential weaknesses. This proactive approach to risk management can positively influence insurers and result in lower premiums.

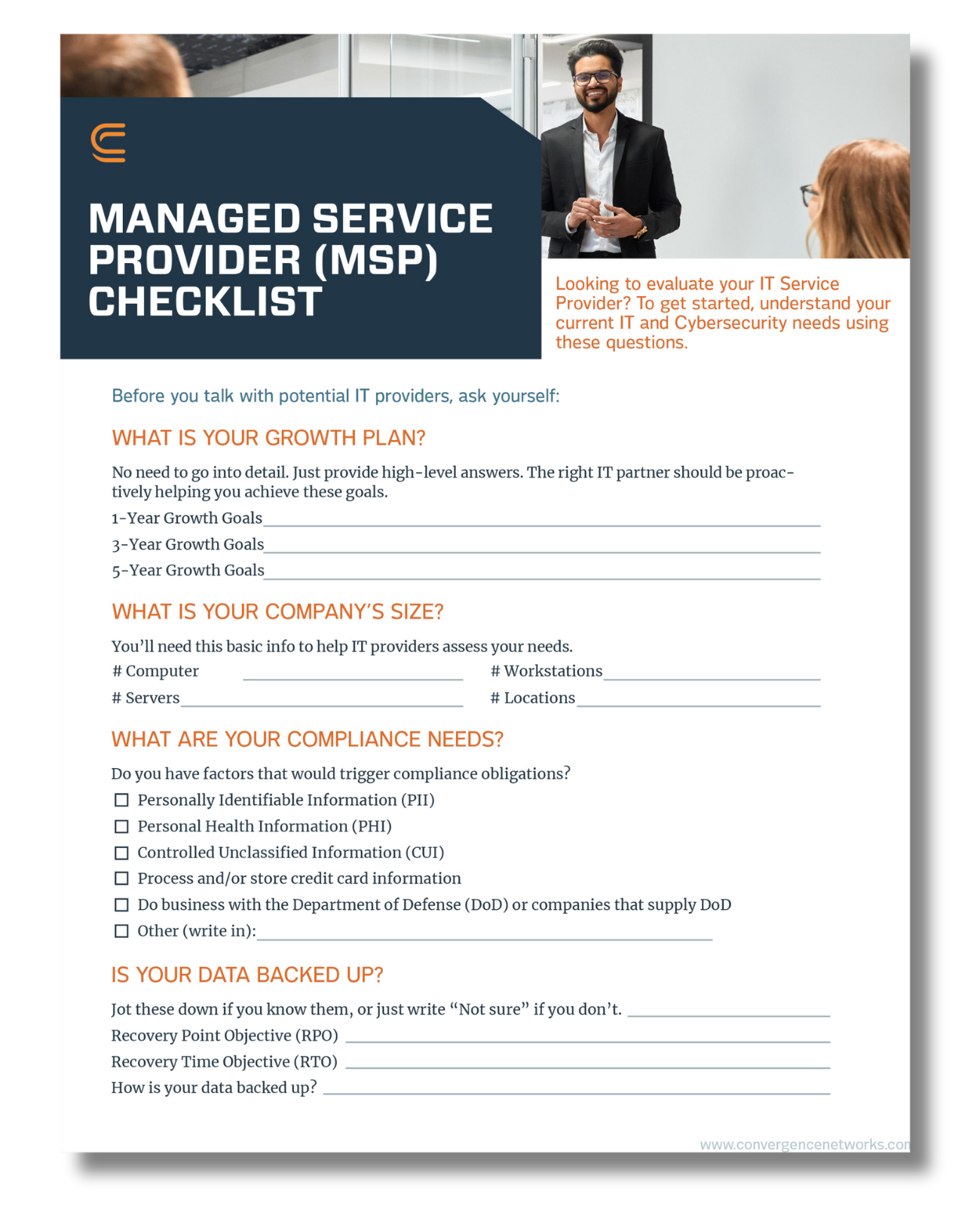

Not Sure Where to Get Started?

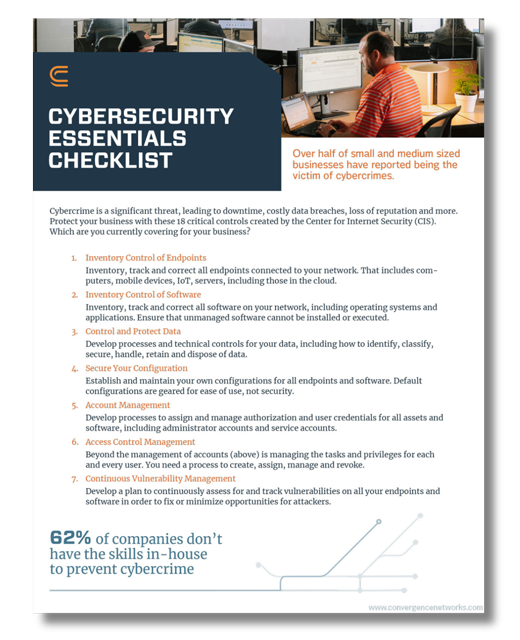

Download our Baseline Cybersecurity Controls Guide below to help you understand what controls your business should implement to reduce the risk of an incident, and ultimately lower your cyber insurance premiums.

Cyber Risks Are Increasing And Most Businesses Are Not Doing Enough

75%

of companies experience at least one cyberattack.

41%

of businesses that have cyber insurance coverage that would be sufficient to cover losses from a significant cyber event.

3%

of business leaders rate their company’s Cyber Hygiene as excellent even though good cybersecurity controls lead to a reduction in cyber insurance premiums.