You know by now that even though you might be a small or medium-sized business, you need cyber insurance to cover any breaches to your data. Cyber criminals don’t really care how big or small you are. They just want to “break in,” cause havoc and get some monetary rewards for doing so. Cyber insurance is an important part of your overall cyber security plan.

We are not a cyber insurance provider, but we’ve seen the impact of good (and not so good) cyber security insurance on our clients. Before signing up with any insurance company or reexamining your current policy, ask these key questions to make sure you understand what is (and isn’t) covered.

1. Business Interruption

Will the insurance cover the costs incurred from a cyber event, natural disaster or human error which prevents you from supplying services to your customers?

2. Cyber Extortion

What about the costs of cyber extortion such as ransomware? Often when your company is the victim of a data breach, you might need to hire a negotiator or investigators, as well as covering the cost of an actual ransom payment.

3. Social Engineering

What if your employees are tricked into taking actions that either direct money to criminals or allow cyber criminals into your network to act for themselves? This is a common ploy that these malicious actors use to compromise your system. Will your current insurance cover those expenses?

4. Harm to Your Company’s Reputation

Does your insurance cover damage to your brand, reputation or business due to a security breach? How long after an event? Does it include the costs of implementing a PR agency’s reputation management recommendations (if not the agency fees themselves)?

5. Forensic Expenses

Does your cyber security insurance coverage include the costs of investigating, isolating and eliminating a threat?

6. Legal Expenses

Will it cover the costs of a lawsuit, settlement costs and any other legal expenses that result from a data breach?

7. Regulatory Expenses

If regulators determine that your business failed to adequately protect sensitive consumer data, will it cover those fines and penalties?

8. Notification Expenses

If you have a data breach you will need to notify clients that their data might have been compromised. Will your cyber insurance cover the cost of setting up a call center to field client concerns?

9. Repairing the ID Theft for Impacted Customers

If you have been breached, customers might have less faith in your ability to protect your data. A credit monitoring program and ID theft repair program can mitigate their concerns. Will your insurance policy cover those costs?

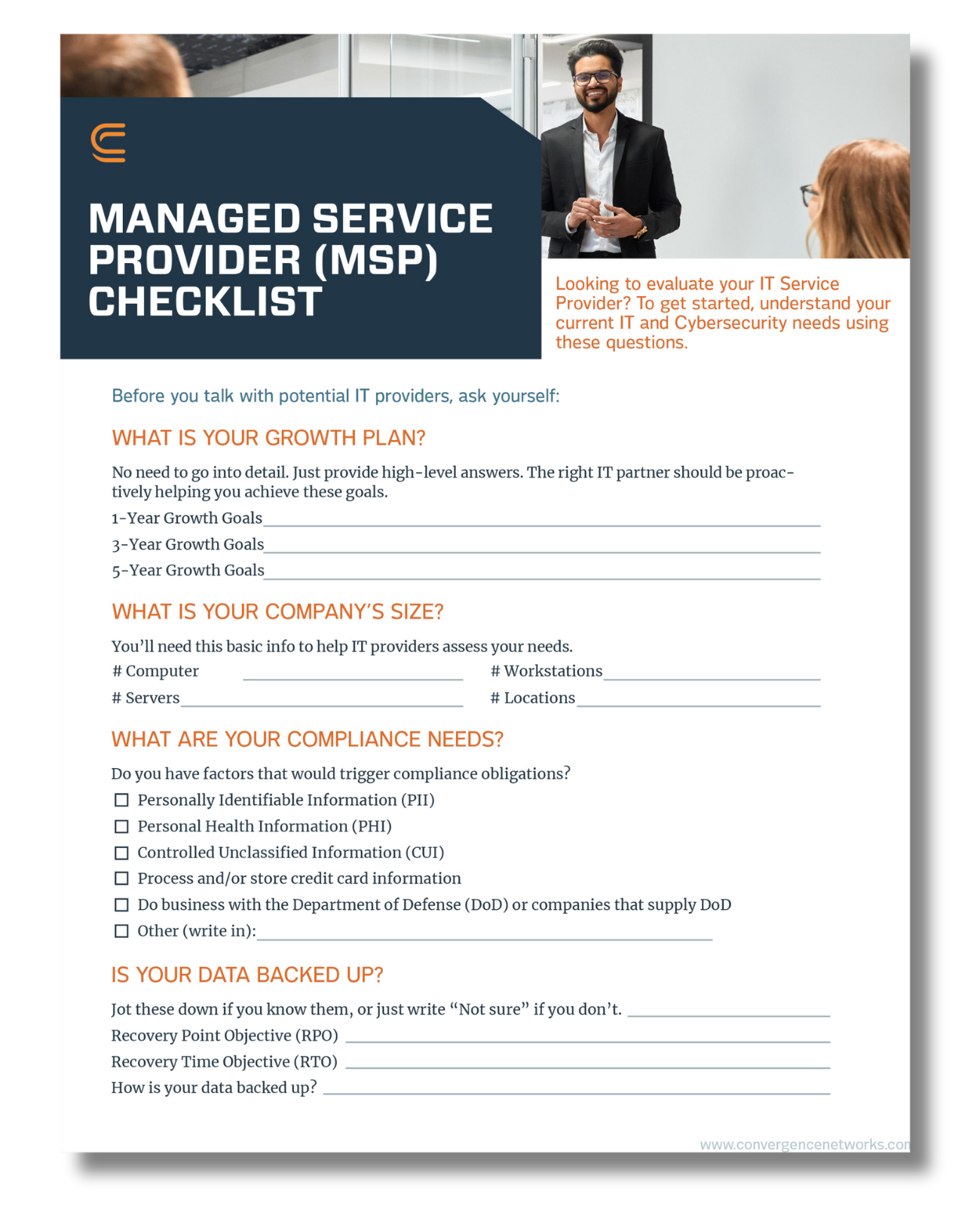

Assessing Your Cyber Security Insurance Policy

Here at Convergence Networks, we hope that none of our clients suffer a breach. The best way to prevent this is to have a cyber security plan in place beforehand. Let’s talk about your IT and cyber security needs.