In light of recent high-profile breaches targeting prominent retailers, the importance of adhering to Payment Card Industry (PCI) regulations has become evident. However, it is crucial to recognize that these rules are not exclusive to large corporations alone. Every business that relies on credit and debit cards for transactions, regardless of its size, is obligated to comply with the Payment Card Industry Data Security Standard (PCI DSS or PCI). Even if your company has a small staff and conducts only a handful of credit card transactions each month, maintaining PCI DSS compliance is a must.

What is PCI DSS Compliance

Ultimately the goal of PCI is to ensure companies are protecting their customers credit cardholder data. This program was created by major credit card companies, including Visa, Mastercard, American Express, Discover, and JCB International, to establish a consistent framework for securing cardholder information. Compliance with the PCI DSS is mandatory for any organization that handles credit card data, including merchants, financial institutions, and service providers. Compliance is typically validated through self-assessments or by engaging a qualified security assessor for an external audit, like Convergence Networks.

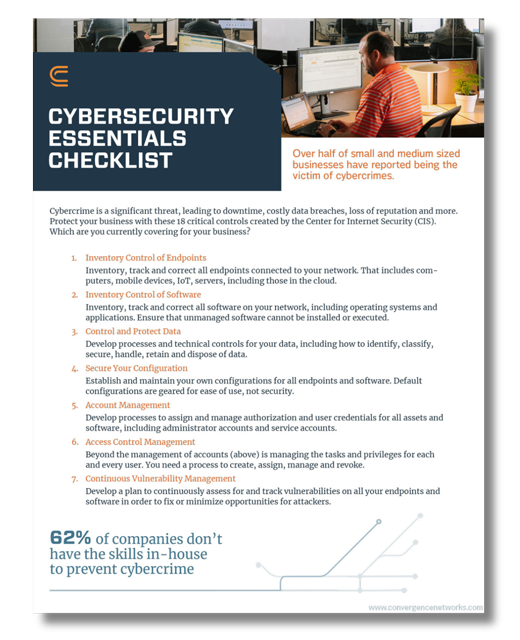

The PCI DSS outlines a comprehensive set of requirements that organizations handling credit card data must comply with in order to prevent data breaches and protect sensitive information. These requirements cover various aspects of security, including network architecture, data encryption, access control, monitoring, and security policy implementation.

- Building and maintaining a secure network and systems: This involves installing and maintaining firewalls, using unique passwords, and regularly updating security software.

- Protecting cardholder data: Organizations are required to encrypt cardholder data both in transit and when stored, as well as implementing access controls and restricting data access on a need-to-know basis.

- Implementing strong access control measures: This includes assigning unique IDs to each user, restricting physical access to cardholder data, and regularly monitoring access to systems.

- Regularly monitoring and testing networks: Organizations must track and monitor all access to network resources, as well as conduct regular security testing and vulnerability assessments.

- Maintaining a policy that addresses information security: Developing and maintaining a comprehensive security policy that addresses all aspects of the PCI DSS requirements is essential.

The Importance of PCI Compliance

While this standard doesn’t guarantee a data breach won’t occur to your business it adds important safeguards against an attack. By adhering to the PCI DSS, organizations can:

- Mitigate the Risk of a Breach – Achieving and maintaining PCI compliance involves implementing robust security measures, such as encryption, secure network architecture, access controls, and regular vulnerability assessments. These measures significantly reduce the risk of data breaches and enhance your overall security posture.

- Protects Customer Cardholder Data – One of the primary reasons for PCI compliance is to protect customer data. As a business owner, you have a responsibility to your customers to ensure that their credit card information is handled securely.

- Improve Customer Trust and Loyalty – As we all know, customer trust is invaluable. By achieving PCI compliance, you can demonstrate your commitment to protecting customer data and a trustworthy organization. Customers are increasingly concerned about the security of their credit card information and are more likely to engage with businesses that prioritize data protection. By achieving PCI compliance, you enhance customer trust, foster loyalty, and gain a competitive edge in the marketplace.

- Strengthen Your Security Posture – PCI compliance is not just about meeting regulatory requirements; it also serves as a foundation for a comprehensive security framework. The security measures mandated by PCI DSS, such as network segmentation, intrusion detection systems, and regular security testing, contribute to an overall robust security posture. By implementing these measures, you strengthen your entire security infrastructure and safeguard other sensitive information and critical systems within your organization.

Getting Started with PCI DSS Compliance

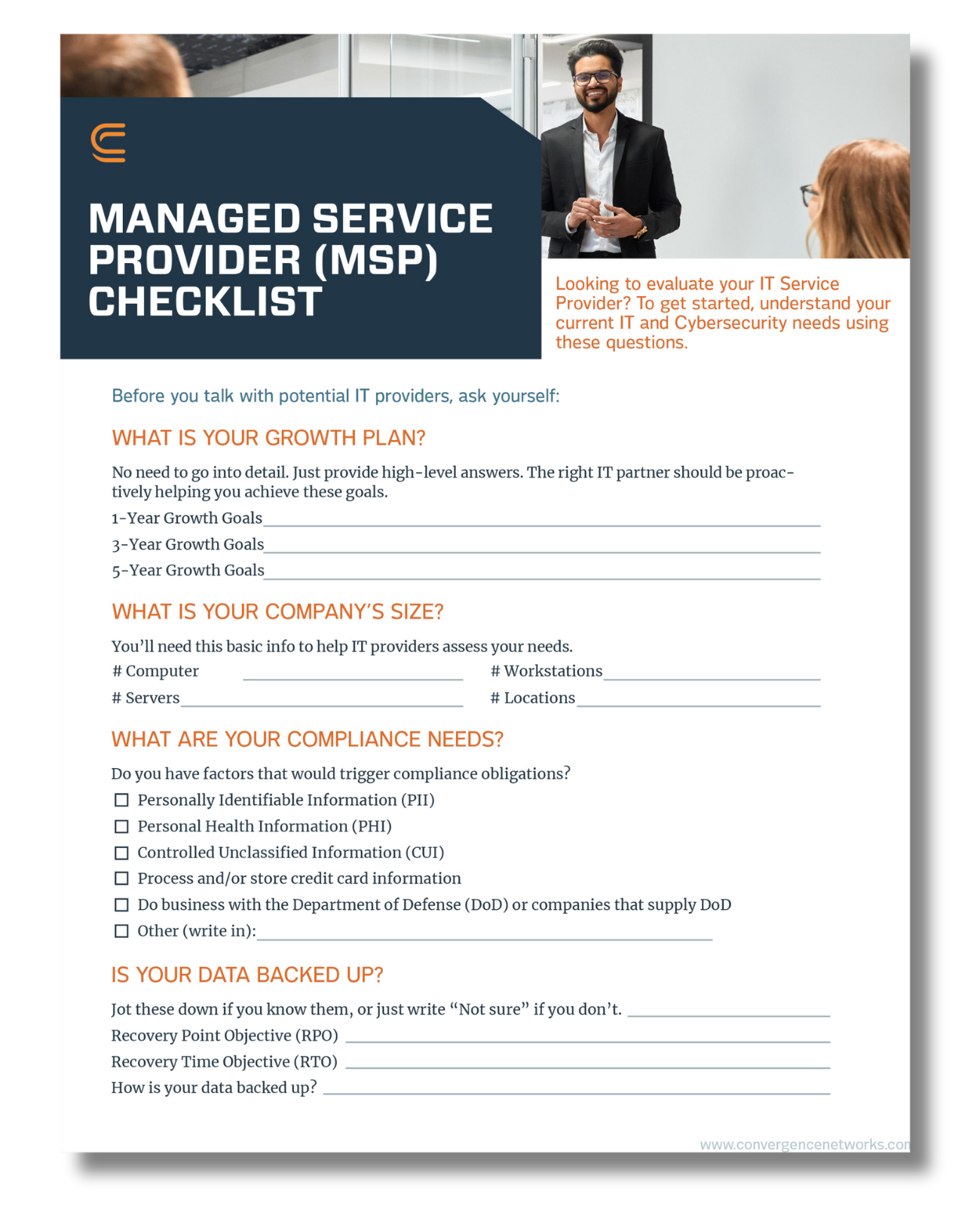

It can be tricky to know where to start when it comes to any type of compliance. Ahead of your PCI DSS Assessment you should first take the time to identify all the relevant business and customer data that is considered in scope.

To do this you must identify all locations and flows of account data, and all systems that are connected to or, if compromised, could impact the CDE (for example, authentication servers, remote access servers, logging servers) to ensure they are included in the PCI DSS scope. All types of systems and locations should be considered during the scoping process, including backup/recovery sites and fail-over system. While this is often the most difficult part of the PCI compliance program, if not done correctly it can add unnecessary costs.

In order to obtain your PCI certification, you will need to complete a PCI DSS audit. A qualified security assessor, like Convergence Networks, can perform the audit. While obtaining the certification is not required for your business to be PCI compliant, it can help you build trust with your partners and customers.

By achieving PCI compliance, you show your dedication to protecting valuable customer data and establishing trust. Whether your business accepts payment cards via a Point-of-Sale (POS) or Property Management System (PMS) system, a custom payment application, or even a web terminal, our team is well-versed in all these systems and comprehends their influence on compliance. We can collaborate closely with you to revamp processes, train your staff, and implement effective controls.

If you are ready to learn more about PCI DSS Compliance and the journey to obtaining your PCI certification, contact us. We can help you ensure you are protecting customers credit cardholder data.