Managed IT Services and IT Support - USA & CANADA

Start Here.

Go Further.

Fueled by outstanding customer service and a passion for innovation, we’ll guide your business through integrated solutions across a wide range of technologies and security services.

One of North America’s leading managed service and managed security service providers.

The adventure begins with a continuous exploration beyond the boundaries of other technology solutions. We speak “human” fluently as we help our clients navigate the diverse terrain of technology. The result? An authentic partnership that is fulfilled by client success; a culture built on trust and autonomy that drives new discoveries and excellence to stay miles ahead of the rest.

As a security first IT services company with offices

Strategy, Security, and Support.

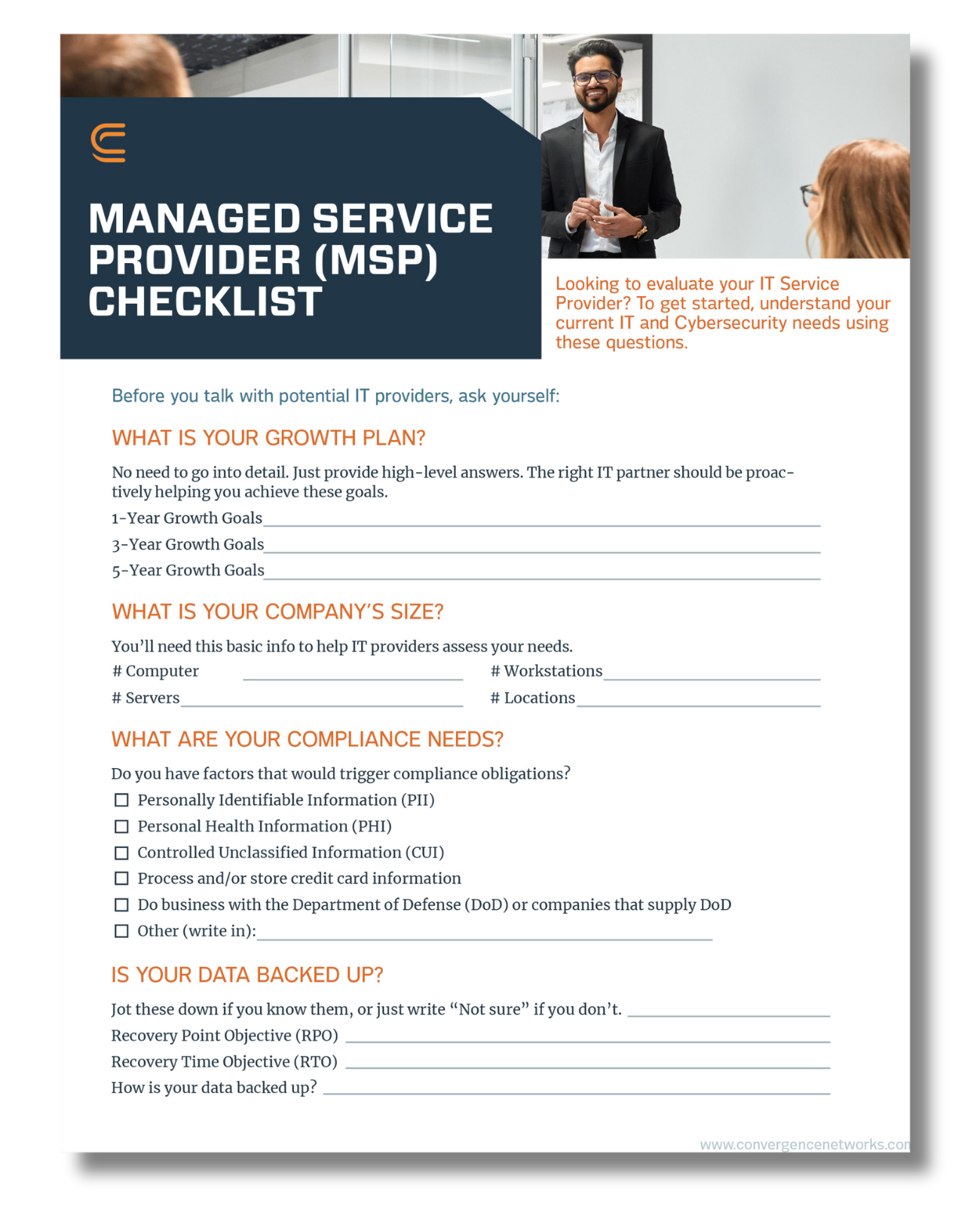

Let’s Navigate Your Technology Decisions Together.

If technology feels like an anchor that is keeping your business from maximizing its potential – it’s time to experience a new kind of managed technology in

Strategic Technology Guidance for Tomorrow’s Business Environment.

Convergence Networks is a place where GREAT business strategists, technologists, and cybersecurity experts thrive. With a core focus on people, there are four specific attributes that make us unique:

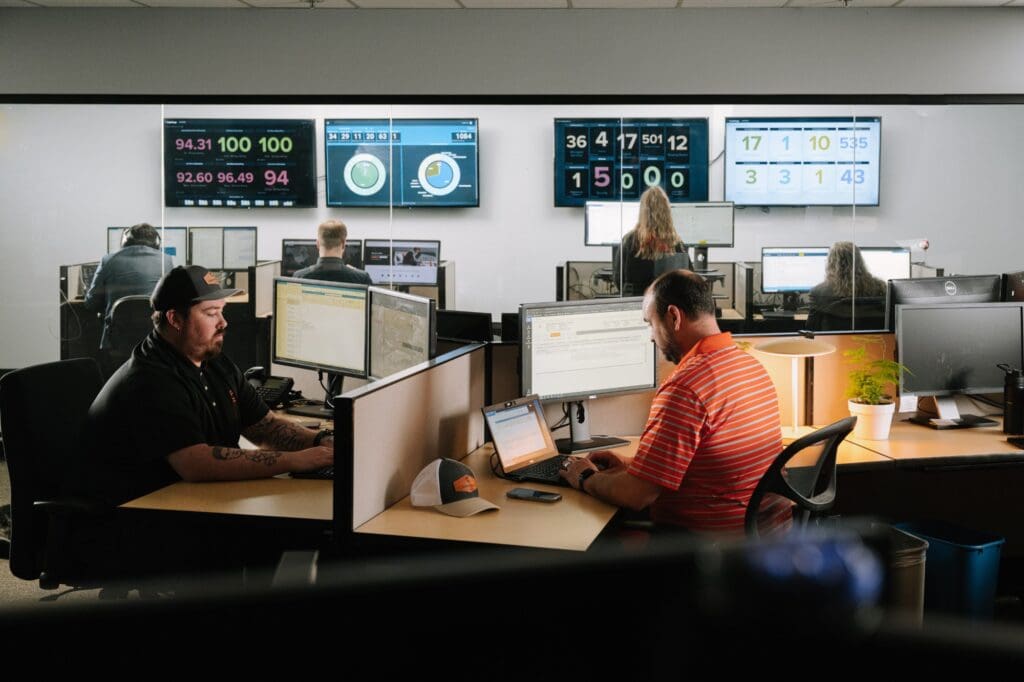

Local Dedicated Service

We provide personalized, local IT support to clients backed by team members who stand ready to assist when needed

Comprehensive Technology Capabilities & Experience

Our clients have confidence that they will work with a skilled team of 200+ people who understand their business and can help them prioritize and quickly solve their IT challenges, so they can focus on what they do best.

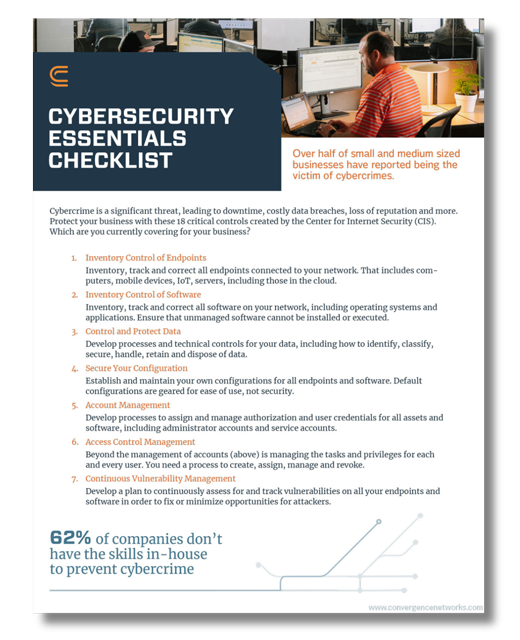

Full Stack Cybersecurity Services & Solutions

Our clients have access to advanced cybersecurity tools and our own 24x7 in-house experienced SOC and NOC teams ensuring their security is put first.

Remaining Ahead of the Evolving Technology Landscape

Embracing technological change, we invest in the latest advancements and certifications while continuously vetting solutions to prepare our clients for the future.