It’s not a secret. Cyberattacks are becoming more complex and severe across all industries. Regardless of the nature of your business, the size, or your location, you are at risk, and you need to take cybersecurity seriously.

You might expect that cybersecurity falls solely under your IT department teams umbrella however, this is a huge misconception. Every single aspect of the business has a component of security that requires a great deal of strategy and planning. And it starts at the top – with your CFO.

The role of the CFO is connected to cybersecurity by a fiduciary responsibility to ensure the investment matches the risk. They are responsible to make sure the business is doing everything possible to stay safe from an attack, and are often the sole person accountable for cyber liability. Whether the plan is to safeguard the business from external threats such as ransomware, or internal threats from either a rogue employee or an employee error, one aspect stays true – when the CFO and ultimately the company do not truly understand the importance of security, they become vulnerable to attacks.

Being prepared is the best way to stay safe.

Generally, the more proactive and seriously a CFO takes security, the safer the organization becomes. A culture of security starts at the top. The CFO may not be the one monitoring the systems and staying up to date on cybersecurity news, but it is their job to surround themselves and partner with people who understand the products and procedures necessary to keep the company safe.

Not convinced? Here are a few reasons why you – as a CFO, should care about cybersecurity.

Financial Impacts

$4.45 million. This is the average financial cost of a cybersecurity attack (Research by Ponemon Institute), and just the cost written down on paper. There are also a magnitude of hidden costs that can trickle down due to loss of revenue, including damage to the brand reputation, operational disruptions, significant operational downtown, and strained relationships with partners, clients, and vendors.

When you see these numbers, the investment in cybersecurity suddenly seems minimal. For a CFO it is not just about investing in technology, but investing in a culture of foundational security that becomes an operational asset.

Cyber Liability Insurance

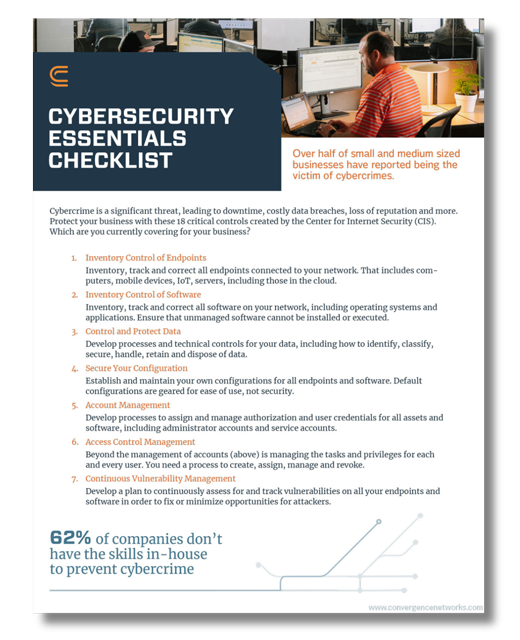

Cyber liability insurance protects a company from the cost of a cyber incident or breach involving computers and data. With security incidents becoming increasingly common, more and more businesses are looking to cyber insurance to protect themselves from the financial and legal damages of an attack. However, what businesses often overlook when they begin evaluating their policy options is that there are several requirements the company must meet in order to qualify for a cyber liability policy.

To get cyber liability insurance, your business must comply with regulations outlined by your provider, and complete ongoing due diligence to ensure you have processes and policies in place to keep the organization safe. Due to the increase in attacks, the insurance industry is taking a tough and unwavering stance on cybersecurity – and rightfully so. Depending on the size of the business and industry, companies are often required to have regular backups, testing, and other basic IT security standards in place.

Industry Specific Compliance Requirements

The realization that being compliant can mean all or nothing in terms of winning contracts for work has caused many CFOs and executives to reevaluate their priorities and business objectives. The CFO must learn to balance stringent cybersecurity requirements with day-to-day operations. Technology should not only meet regulations, but it should also enable the workforce to continue to operate. At the end of the day, it is one thing to be compliant to get the contract and bring in cashflow, but your company also needs to keep operations functional and end users happy. CFOs and other C-level executives are having to take a hard look at how their business operates, and the impact the compliancy regulations will have on operations.

Cybersecurity is a risk mitigation.

Businesses fall victim to an attack when they leave their doors open. If the CFO doesn’t make cybersecurity a priority for the organization the business is put at risk.

A great CFO doesn’t act as a barrier when it comes to technology investment. They understand the opportunity cost and think about long term sustainability. The initial investment in cybersecurity may look unnecessary on paper but if you want to protect your business you need to be proactive. It is more costly to suffer from an attack and just “hope” it doesn’t happen again, than investing in security solutions and building a culture of cybersecurity.

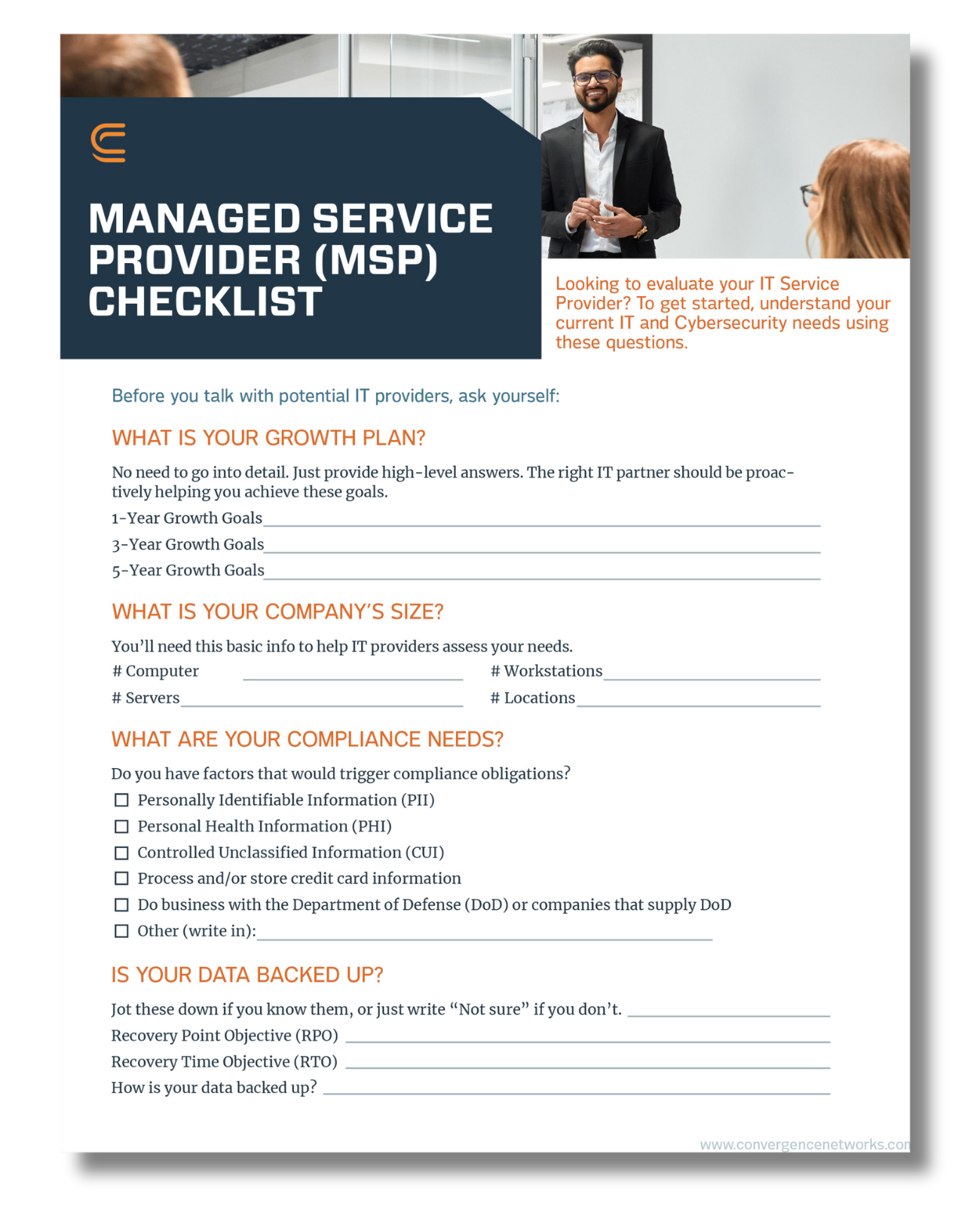

Want to explore your investment options?

A culture of cybersecurity starts at the top, and it’s critical to have strategic partners that understand your unique business requirements. At Convergence Networks, we start by understanding your business and identifying your cybersecurity gaps. From there we identify the investments and best practices that will best help you build a strong foundation, delivered by our security-first strategic and support teams. Contact us today to learn more about our process and the investments you can make to keep your company, customers, employees, and partners safe.

Want to learn more? Visit our website to learn more about our Managed Security Services and Cybersecurity Projects.