Cybersecurity is a vital aspect of any business that relies on technology to operate, store, or transmit data. However, no matter how much you invest in cybersecurity solutions, there is always a possibility of a cyberattack that could compromise your network and data. In fact, every 39 seconds, a threat actor targets a business’s cybersecurity infrastructure, making it even more important to protect your business.

This is where cyber insurance comes in.

What is Cyber Insurance?

Cyber insurance, also known as cyber liability insurance or cyber risk insurance, is an insurance product designed to protect businesses from the financial losses and legal liabilities that may result from a cyberattack or data breach. While each policy differs, cyber insurance can cover various expenses and damages, such as:

- Costs of restoring or replacing data, systems, and hardware that were damaged or destroyed by a cyberattack

- Costs of notifying customers, regulators, and other stakeholders about a data breach and providing them with credit monitoring or identity theft protection services

- Costs of hiring forensic experts, public relations consultants, and legal advisors to investigate and respond to a cyber incident

- Costs of defending against lawsuits, regulatory fines, or penalties that may arise from a cyber incident

- Costs of compensating customers, business partners, or third parties that suffered losses or damages due to a cyber incident

- Costs of business interruption or lost income due to a cyber incident

Advantages of Cyber Insurance for Your Business

According to IBM, the global average cost of a data breach in 2023 was $4.45 million, a 15% increase over 3 years. This means that cyberattacks are becoming more frequent, sophisticated, and costly, posing a serious threat to businesses of all sizes and industries. Therefore, having cyber insurance is not only a prudent risk management strategy, but also a competitive advantage that can help you:

- Reduce the financial impact of a cyber incident and recover faster

- Enhance your reputation and customer trust by demonstrating your commitment to cybersecurity and data protection

- Comply with the regulatory requirements and industry standards that may mandate cyber insurance coverage

- Access the expertise and resources of the cyber insurance provider, such as incident response teams, risk assessment tools, and best practices

- Gain a competitive edge over your rivals who may not have adequate cyber insurance coverage

However, cyber insurance is not a substitute for cybersecurity. In fact, having good cybersecurity practices is essential in order to even get a cyber insurance policy. While it may help you mitigate the residual risks that cannot be eliminated by cybersecurity solutions. To get the full benefits of cyber insurance, you need to have a comprehensive cybersecurity framework that covers all aspects of your cyber risk management.

Having a Cybersecurity Framework in Place is Essential

A cybersecurity framework is a set of policies, practices, and procedures that guide your organization in identifying, protecting, detecting, responding, and recovering from cyber threats. A cybersecurity framework can help you:

- Establish a clear and consistent vision, mission, and goals for your cybersecurity program

- Assess your current cybersecurity posture and identify the gaps and weaknesses that need to be addressed

- Implement the appropriate safeguards and controls to protect your assets, data, and systems from cyber threats

- Monitor and detect any anomalous or malicious activities on your network and systems

- Respond quickly and effectively to any cyber incidents and contain the damage

- Recover from a cyber incident and restore normal operations as soon as possible

- Learn from the cyber incident and improve your cybersecurity program

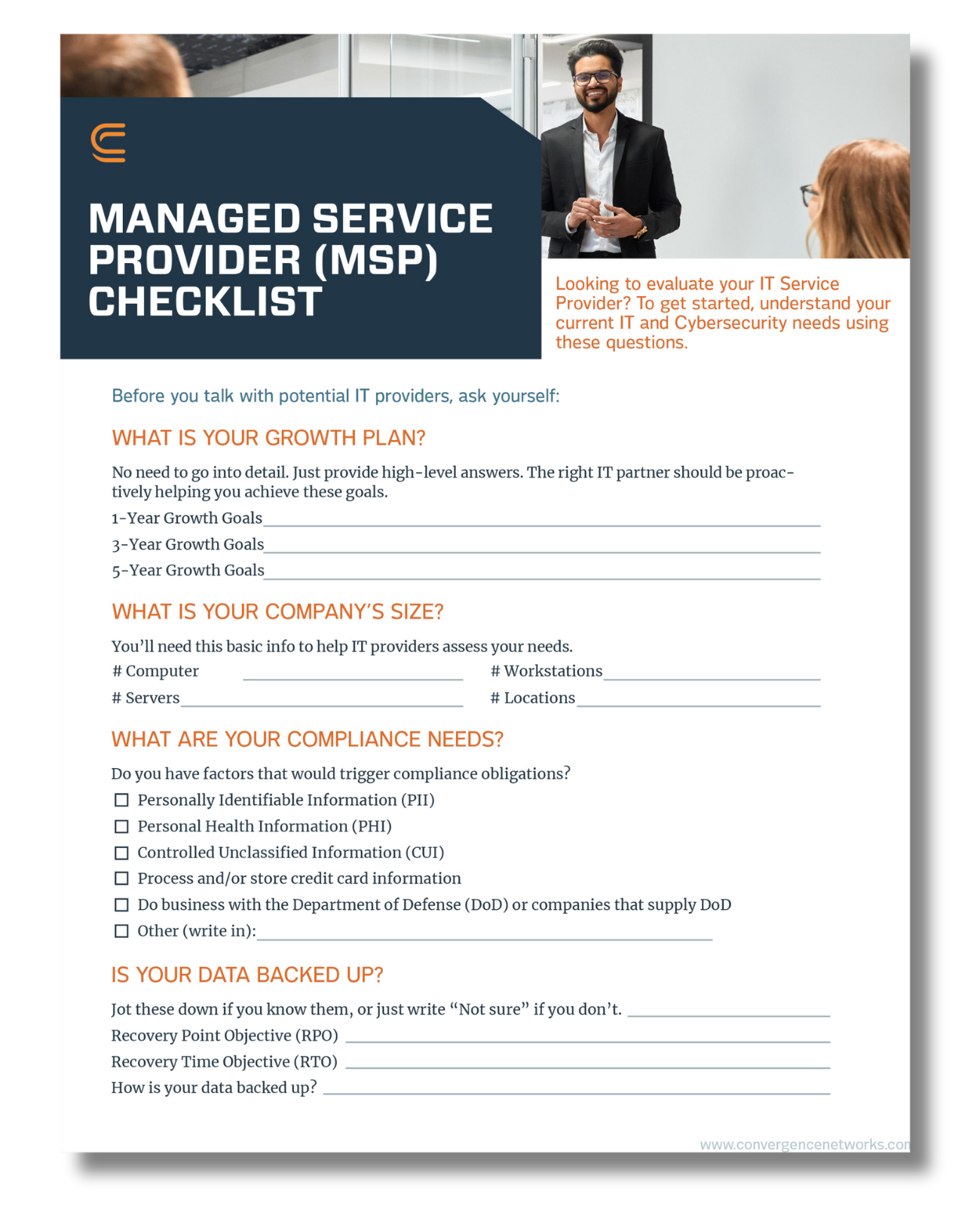

There are various Cybersecurity Compliance Frameworks your business can follow depending on your industry. A cybersecurity expert can help you understand which framework best suits your organization’s needs, or create your own customized framework based on the best practices and recommendations from different sources. The important thing is to have a cybersecurity framework that is aligned with your business objectives, risk appetite, and cyber insurance policy.

By having a cybersecurity framework, you can not only enhance your cybersecurity posture and resilience, but also improve your cyber insurance coverage and premiums. Cyber insurance providers will evaluate your cybersecurity framework before issuing a policy, and offer better terms, conditions, and premiums if you have a robust and mature framework. Moreover, having a cybersecurity framework can help you prevent or minimize the occurrence and severity of a cyber incident, which can reduce the likelihood and amount of a cyber insurance claim. Furthermore, having a cybersecurity framework can help you document and report a cyber incident more accurately and efficiently, which can expedite the cyber insurance claim process and settlement.

Ultimately, cyber insurance is important to protect your business, should a cybersecurity incident occur. However, you must remember that to get the most out of your cyber insurance, you need to have a comprehensive cybersecurity framework that can help you prevent, detect, respond, and recover from cyber incidents. By combining cyber insurance and cybersecurity, you can achieve a higher level of cyber resilience and business continuity.

At Convergence, we have partnerships available to our customers with leading insurance companies in North America. With our robust cybersecurity protocols our customers can benefit by taking advantage of these partnerships to get a simplified underwriting process, limits of insurance and realize a discounted rate. Interested in learning more? Contact us here or reach out to your Convergence Networks representative for more information on our Cyber Insurance offering.